Release time: 2023-05-12 14:24 Source: Longzhong Information Editor in charge: Wu Xiaoyan

Recently, the price of domestic isoprene rubber has continued to fluctuate weakly, and some competitive customers still have low-end prices. The domestic supply is abundant, and downstream demand is weak. It is difficult for the isoprene rubber market to make a breakthrough. As of the receipt of the manuscript, the Russian IR970 (SKI-3) offer is 12400-12500 yuan/ton, and the real order is negotiated.

1. The price of upream isoprene is lowst

来源:隆众资讯

Recently, the price of upstream isoprene has been mainly consolidating at a low level. Although there will be maintenance of China-Korea installations and Shanghai petrochemical installations in the later stage, the supply side will support the confidence in the isoprene market, but the downstream demand will be sluggish, and the cycle of relieving the contradiction between supply and demand of isoprene will be relatively short. In the long run, the market will continue the trend of low level consolidation.

2. Sufficient supply of isoprene rubber

Table 1 List of isoprene rubber plants

Manufacturer | Device status |

Guangdong Luzhonghua | running |

Fushun Yikesi | running |

Xinjiang Tianli | running |

At present, the three sets of isoprene rubber plants in China are running smoothly, and the supply of imported goods is relatively sufficient, and the supply side competition in the isoprene rubber field is relatively fierce. Some manufacturers have price competition in the field for shipment, and some brands There is an under offer at the price.

3. The start-up trend of downstream tire companies has improved

来源:隆众资讯

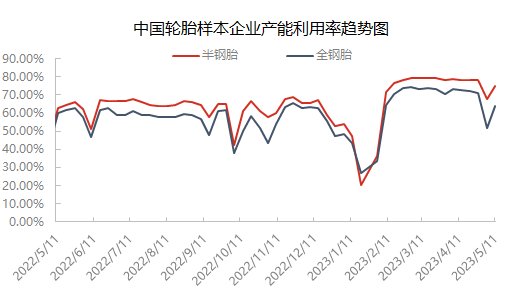

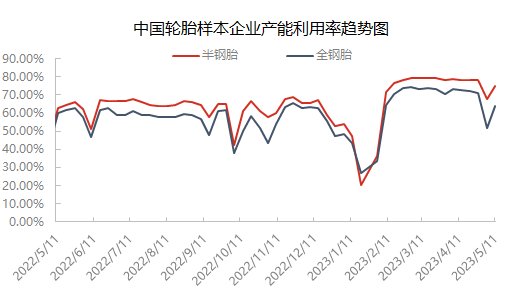

Recently, the capacity utilization rate of Chinese semi-steel tire sample enterprises was 74.70%, +7.01% month-on-month, and +12.16% year-on-year. The capacity utilization rate of all-steel tire sample enterprises was 63.89%, +12.37% month-on-month, and +3.69% year-on-year. After the "May 1st" holiday, most of the maintenance companies resumed work according to the plan. Most of the other sample companies resumed work and maintained stability. During the week, the domestic sales of enterprises were generally average, and foreign trade and other vehicles were mainly shipped, and the overall inventory of enterprises increased slightly.

4. Summary

On the whole, the sample capacity utilization rate of downstream tire companies is still expected to rise slightly. Some enterprises were overhauled in early May, and the capacity utilization rate of the sample enterprises was gradually increasing. At present, most of them have returned to the normal level. Coupled with the support of foreign trade orders, the overall capacity utilization rate of the sample enterprises continued to increase slightly. There is a boost to the circulation of isoprene rubber sources, but most companies maintain fixed channel procurement, and the supply of isoprene rubber is sufficient, and it will take some time to alleviate the contradiction between supply and demand. At the same time, the price of upstream isoprene is low and volatile, and the cost side is difficult to support. It is expected that the isoprene rubber market will continue to be depressed in the short term, but in the long run it is still necessary to pay attention to demand factors.