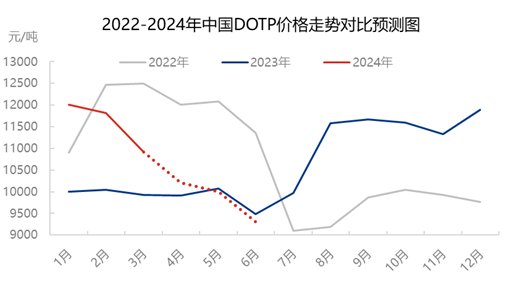

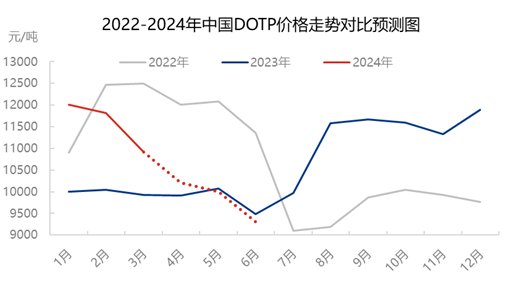

Introduction: The DOTP market fluctuated in the first quarter, with prices falling from the highest level in the same period in the past three years to the lowest price in the same period in the past three years, setting the fastest decline rate in the traditional peak season of March. However, towards the end of the quarter, driven by costs, the DOTP market price rebounded strongly. Can the market maintain its strength in the second quarter?

Negative factors dominate, DOTP prices fell sharply in the first quarter

数据来源:隆众资讯

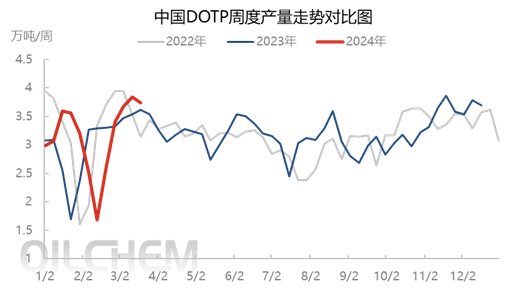

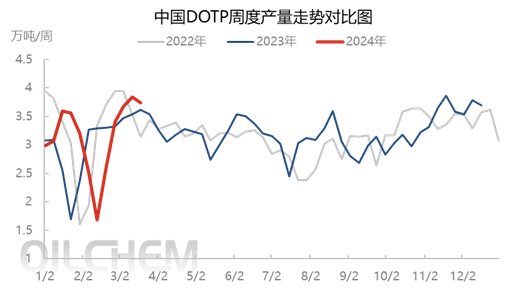

The DOTP market fluctuated downwards in the first quarter. Taking the Zhejiang market as an example, as of now, the average price of DOTP in the first quarter is 11,585 yuan/ton, which is slightly lower than the average price in the fourth quarter of last year by 0.15% month-on-month, and a year-on-year increase of 15.94% from the first quarter of last year. DOTP prices have fallen from the highest level in the same period in the past three years a year ago to the lowest level in the same period in the past three years.

Among them, January and February were around the Spring Festival holiday, and the DOTP market mainly consolidated at high levels and within a narrow range. Due to the expected maintenance of the raw material octanol storage equipment after the Spring Festival, DOTP industry players have certain confidence in the post-holiday market before the Spring Festival, which supports the consolidation and operation of the DOTP market price at a high level.

However, the post-holiday demand recovery for end product orders is less than expected, downstream factories are slow to resume work, and the DOTP buying atmosphere lacks support; in addition, the benefits of the maintenance of the octanol unit, the main raw material for DOTP cost, have been digested in advance, and plasticizer companies have sufficient stocks of raw material octanol, and imports Octanol's impact on the domestic market has made it difficult for the domestic price of octanol to support, and the cost of DOTP is also bearish. Dominated by negative factors, DOTP prices began a continuous decline since the end of February. The decline expanded in March, and the continuous decline lasted for nearly a month. In late March, it fell below the 10,000 yuan mark, with a drop of more than 17% in one month.

However, towards the end of the month, driven by the rebound after the raw material octanol oversold, the DOTP market bottomed out and ended with a strong rebound after remaining in the downturn for more than a month.

2. Oversupply and DOTP enterprise inventory accumulation

数据来源:隆众资讯

数据来源:隆众资讯

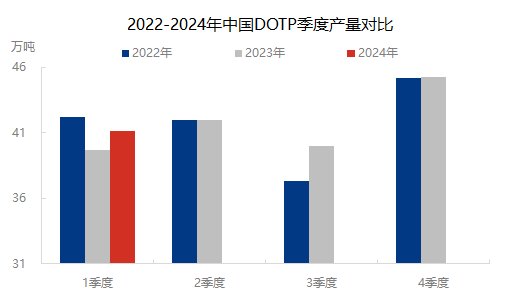

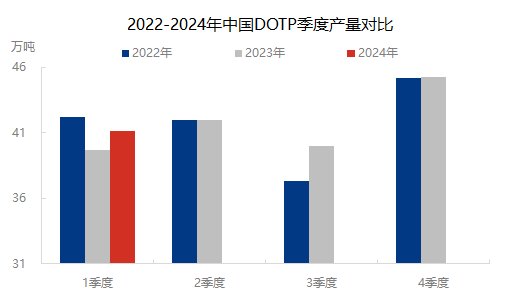

In the first quarter of 2024, the DOTP market has sufficient spot supply, with quarterly output of approximately 411,000 tons, a year-on-year increase of 3.6% from the first quarter of 2023, a slight decrease of 2.48% from the first quarter of 2022, and a 9.19% decrease from the fourth quarter of 2023. Construction started at a low level during the Spring Festival holiday, which was not much different from previous years. However, the resumption of work by DOTP companies after the holiday has accelerated significantly compared with last year. At the end of February and early March, DOTP companies had sufficient theoretical profits, so they were highly motivated to start production. In addition, before the holiday, production companies had bullish expectations for the stock of raw material octanol, so the raw material octanol reserves were sufficient. After the holiday, manufacturers actively started work to consume raw material stocks. The DOTP market output in March was nearly 160,000 tons, setting a record for the highest monthly level in the same period.

数据来源:隆众资讯

数据来源:隆众资讯

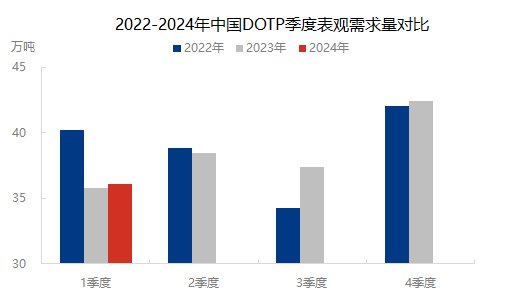

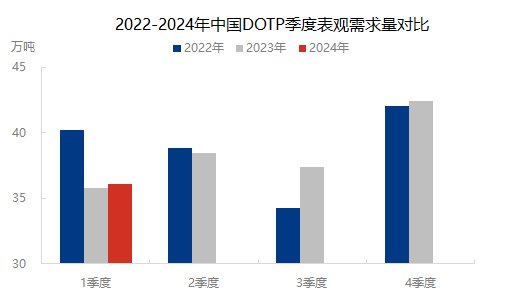

Judging from the apparent demand from 2022 to 2024, the apparent demand for DOTP in the first quarter of 2024 is expected to be 361,000 tons, a year-on-year decrease of 14.88% from the fourth quarter of 2023, and a year-on-year increase of only 0.92% from the first quarter of 2023. In the first quarter of 2022, it fell by 10.15%.

The recovery of terminal demand in the first quarter was not as expected, or even lower than the same period in previous years. After the Spring Festival, PVC product companies resumed work slowly, and the start of production was always lower than the same period in previous years. In particular, due to factors such as insufficient new construction starts in real estate and infrastructure projects, the market demand for PVC construction and decoration materials is limited, and the order situation is not good. Downstream enterprises are not very enthusiastic about DOTP procurement, DOTP supply is increasing and demand is decreasing, production enterprises are not able to sell goods smoothly, and the accumulated inventory of enterprises is gradually increasing.

3. Goods are not flowing smoothly. In the first quarter, DOTP companies turned from profits to losses.

数据来源:隆众资讯

In the first quarter of 2024, the profits of DOTP sample companies have always been low, and they have even been in the red most of the time. Due to theoretical profits after the holiday, DOTP companies are more motivated to start operations. However, the start-up level of DOTP downstream companies after the holiday is low, and the raw materials stored in the factory in the early stage are consumed slowly, resulting in poor transaction of new DOTP orders. Under the pressure of accumulated inventory, DOTP merchants frequently offer profit for shipments. Especially when there is insufficient confidence in the market outlook, traders operate short orders, dragging DOTP down by more than cost, and DOTP corporate profit margins turn from profit to loss. In the first quarter, the average quarterly profit of the DOTP enterprise sample area was -44 yuan/ton, a year-on-year decrease of 85 yuan/ton from the same period last year, and a month-on-month decrease of 57 yuan/ton from the fourth quarter of last year.

4. DOTP market forecast for the second quarter

Towards the end of the quarter, the DOTP market rebounded strongly, mainly driven by costs. In the early stage, in order to stimulate buying and replenishment, domestic octanol factories significantly lowered their quotations. The price of octanol oversold, but the factory could only ship a small amount at low prices, and then the octanol factory began to increase prices. The buying mentality has driven downstream users to become more enthusiastic in entering the market to replenish goods. Coupled with the replenishment of short orders by middlemen, the market transaction atmosphere has been significantly more active. Especially today, Shandong octanol manufacturers are selling limited quantities through bidding, which has significantly expanded the rebound of octanol. The favorable cost support has driven DOTP prices sharply higher. However, after the price of DOTP rose to a high level, the follow-up of buying orders was slightly weak, and the atmosphere of new order transactions obviously weakened.

So can the second quarter maintain the strong level at the end of this quarter?

数据来源:隆众资讯

First of all, from a cost perspective, there are more negative factors in the later period. In the second quarter of 2024, the capacity expansion of the octanol unit, the main raw material of DOTP, will accelerate, which will soon ease the tight supply situation in the octanol market and drag its price back to a relatively rational price level. Therefore, the impact of cost on DOTP price is relatively bearish.

Octanol unit expansion plan in the second quarter of 2024

Product Company name Expanded production capacity (10,000 tons/year) Construction time

Butanoctanol Ningbo Juhua 10 is expected to be put into production in May-June 24

Octanol Anqing Shuguang 23 is expected to be put into production from June to July 2024

Octanol Zhejiang Satellite 40 is expected to be put into production around the end of June 2024

Data source: Longzhong Information

From the demand side, there are both good and bad news. China's external economic environment may improve in 2024, the effects of stabilizing growth policies will continue to show, and domestic demand is expected to continue to recover. As the end of the chemical industry chain, DOTP's downstream products include cables, films, floors, etc., which are closely related to the economy and life. Improvement in domestic demand may drive the growth of rigid demand in the DOTP market. However, world economic growth is still expected to decline in 2024. The cooling of overseas demand will continue to suppress China's exports. As an environmentally friendly plasticizer, DOTP accounts for a high proportion of exports in downstream products. The weak external demand for terminal products will affect the procurement demand for DOTP by downstream companies.

Overall, the current pressure of overcapacity in the DOTP market is difficult to alleviate for the time being, and the expected improvement in demand is limited. Therefore, the DOTP market price in the second quarter may still hover around the cost line, with limited profit margins. As new devices for octanol, the main raw material, are put into production one after another, the price will loosen, and the DOTP market price will also be under pressure. Therefore, although the DOTP market price has been strong recently, in the long term in the second quarter, the overall trend of the DOTP market may fluctuate and weaken after rising. From the monthly average price, the DOTP price may gradually decline.