Introduction: In August, the market prices of butadiene and acrylonitrile, the main raw materials of nitrile latex, showed a gradual upward trend, driving the quotations of nitrile latex market upward, but downstream glove companies had sufficient raw materials in the early stage. Advance is limited.

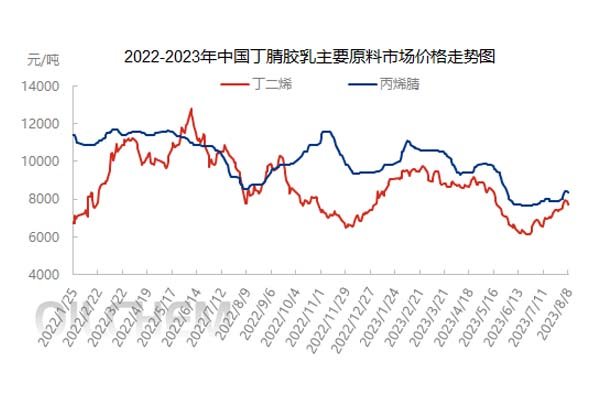

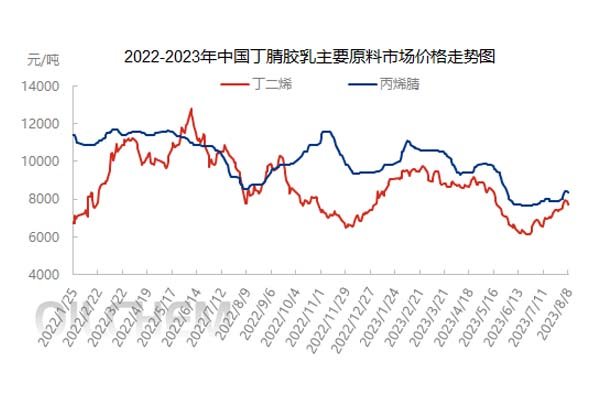

Since the middle and late July, butadiene was supported by the positive factors of rising external markets, tightening supply and the listing of butadiene rubber futures. The market quotations continued to rise in early August, and the rapid rise in prices led to downstream cost pressures. Sudden increase, the enthusiasm for purchasing has weakened significantly. As of August 8, market transactions have fallen. The delivery price in Shandong Luzhong area is 7,600-7,800 yuan/ton, and the price for self-lifting out of tanks in East China is 7,150-7,250 yuan/ton. At the same time, the trend of the acrylonitrile market also shows a market trend of rising first and then falling. With the significant increase in supply and the relatively slow follow-up of demand, as of August 8, the delivery price in the Shandong market was reduced by 50 yuan, and the transaction At 8350 yuan / ton.

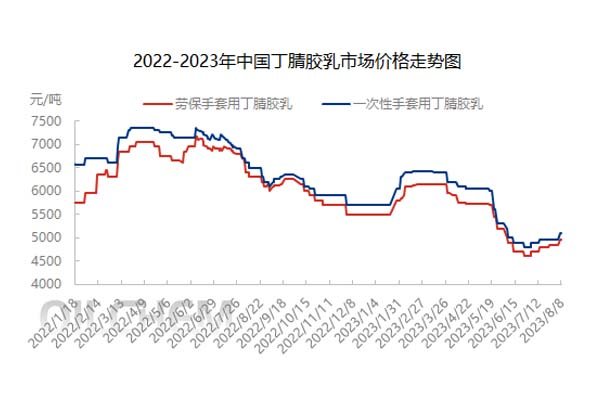

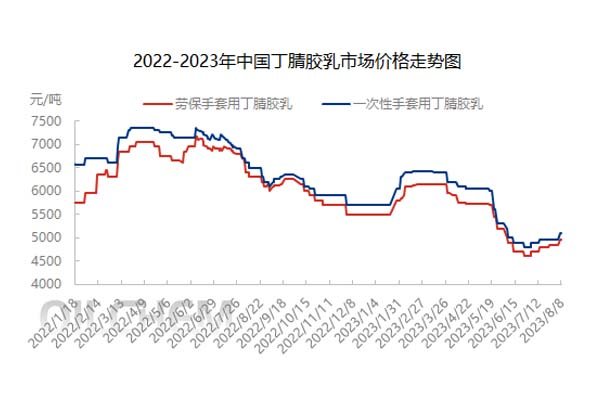

China's nitrile latex market showed a price trend that bottomed out in the first half of the year. In the third quarter, the cost-side price rose and latex companies' offers rose, but market transactions weakened significantly after the price rose. In the early stage, under the mentality of buying raw materials for nitrile gloves, the supply of low-priced latex in stock was more in July, and the previous orders continued to be digested in August. The actual transaction atmosphere in the market was stalemate. As of August 8, the reference price of nitrile latex for labor protection gloves is 4900-5000 yuan/ton, and the reference price of nitrile latex for disposable gloves is 5000-5150 yuan/ton. , the situation of low-price competition for market share among enterprises has eased slightly.

In the first half of the year, the capacity utilization rate of nitrile gloves showed a steady increase. In July of the third quarter, the capacity utilization rate of nitrile gloves was 49.03%, a decrease of 0.2% from the previous month. The orders of domestic nitrile glove manufacturers have gradually picked up, driving domestic nitrile glove manufacturers to start operations. At present, domestic glove orders are mainly concentrated in domestic leading enterprises with first-mover technological advantages and cost advantages, and the utilization rate of nitrile glove production capacity of related enterprises is at a relatively high level.

According to Longzhong Information, orders from Chinese nitrile glove companies were acceptable in August, and the overall start-up fluctuated little. However, at the end of July, Malaysian glove companies lowered prices and cleared their warehouses, resulting in a loss of orders. It is expected that gloves will start production in September or drop slightly. The terminal demand weakens, which may bring the impact of declining orders on the nitrile latex market. With the short-term positive cost support limited, it is expected that the nitrile latex market will continue to fluctuate and adjust between small areas in the future. It is recommended that enterprises prepare stocks reasonably and pay attention to terminal glove enterprises Guidance on opening conditions.