Release time: 2024-06-20 21:52 Source: Longzhong Information Editor: Qi Ying

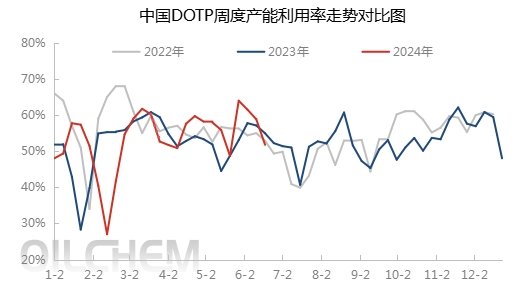

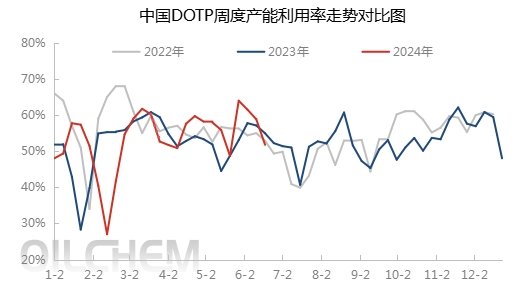

Introduction: June has entered the traditional off-season for the DOTP market. Merchants are facing multiple pressures such as poor transactions and long-term losses. The enthusiasm for starting operations is low, and the load of DOTP devices has dropped significantly. This week, the operating load of DOTP companies is about 52%, down from 64% at the end of May. By 12 percentage points, the current daily output has dropped by nearly 1,000 tons/day compared with the end of May.

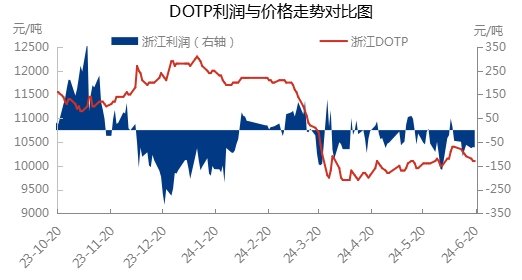

Costs rise more than they fall, DOTP companies continue to lose money

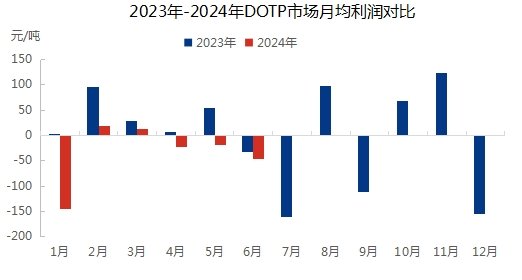

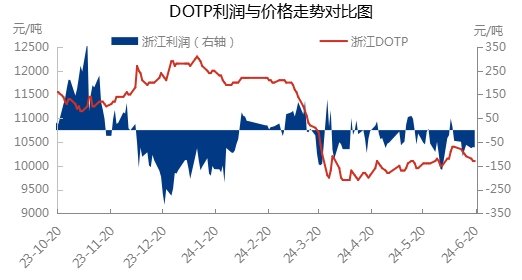

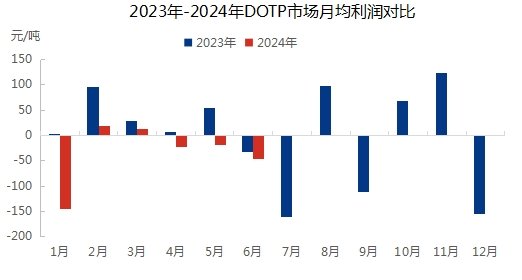

In early June, the price of octanol, the main raw material of DOTP, was supported by good news such as equipment maintenance, expected supply tightening, and the delay in putting new equipment into operation. The good news once led the DOTP market to follow the rise for a short time, but it was eventually dragged down by demand. DOTP The price increase is difficult to match the cost increase, and DOTP companies return to losses after a short period of profit. Especially after returning from the Dragon Boat Festival holiday, DOTP companies' inventory pressure increased, and prices fell under pressure, which caused a correction in octanol prices. However, after all, octanol just needs to exist, and the cost decline rate is much slower than the DOTP price decline rate. Therefore, DOTP companies spend most of their time in a Loss status. As of now, taking the Zhejiang market as an example, DOTP companies have a theoretical loss of 73 yuan/ton, and the average monthly profit in June is -47 yuan/ton, a year-on-year decrease of 46.88%. A month-on-month decrease of 147.37% from May.

Enterprises are under great pressure and DOTP construction starts are declining

June has entered the traditional off-season for DOTP downstream demand. DOTP companies' new orders are not flowing smoothly, and inventory pressure is gradually increasing due to long-term losses. DOTP companies are not very enthusiastic about starting production, and the market capacity utilization rate has dropped significantly. This week, the operating load of DOTP companies is about 52%, which is 12 percentage points lower than the 64% at the end of May. The current daily output has dropped by nearly 1,000 tons/day compared with the end of May. The crude DOTP operating load has dropped from 86% at the end of May to the current 68%, a drop of 18 percentage points, and the daily output has dropped by nearly 300 tons/day. At present, the load of Shandong Lanfan has dropped to 80-90%, Foshan Guansheng has dropped to 50%, Huangshan Hanghua has dropped to 50%, Anqing Litian, Fujian Chunda and other installations have been suspended, etc., and the daily operating rate is only about 5.30%.

Cost demand game DOTP market fluctuates within a narrow range

There are plans to restart some DOTP installations next week. However, in the face of losses, the overall enthusiasm of DOTP companies to start operations is still not high, and the increase in installation load is expected to be limited. It is estimated that the DOTP market capacity utilization rate next week will be around 5.50%, which is a relatively medium level for the year. Some factories will still face inventory accumulation pressure. From a cost perspective, the main octanol spot demand is expected to recover compared with this week, and buyers are acceptable to the current price, which can support the bottom price of the octanol market. Therefore, the cost pressure on DOTP companies is still difficult to alleviate, the game between costs and demand is severe, and companies are in a difficult situation. It is expected that DOTP prices may rise and then fall back. Under the support of costs, short-term DOTP prices are strong, but the demand side lacks the motivation to continue to chase the increase. The overall oversupply of the market will still limit the upward space of DOTP prices.