Release time: 2024-07-12 16:41 Source: Longzhong Information Editor: Shang Aiting

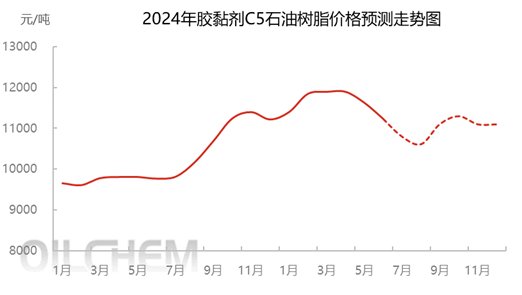

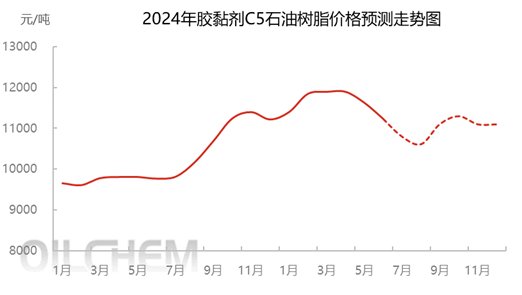

【Introduction】 In the first half of 2024, due to the influence of policies, the domestic C5 petroleum resin market has seen concentrated replenishment both at home and abroad. In addition, there were many temporary maintenances of foreign equipment at the end of the first quarter and the beginning of the second quarter. The shortage of domestic C5 petroleum resin continued until May. Driven by demand, the spot price rose by 1,000-1,500 yuan/ton. In the second half of the year, due to the excessively high shipping costs in the third quarter and the traditional off-season in China, the price fell significantly. Although with the arrival of the traditional peak season, the price of C5 petroleum resin will rebound due to the increase in raw material costs and policies, it may be difficult to reach the high level in the first half of the year.

1. C5 petroleum resin increased significantly in the first half of the year

Data source: Longzhong Information

The overall market performance in the first half of 2024 is positive, mainly due to the sharp increase in costs caused by the policy of cracking C5 residual liquid. In the first quarter, the risk aversion sentiment of C5 petroleum resin downstream of road sign paint increased, which led to the concentration of stocking demand. Manufacturers mostly produced according to orders, and the spot volume of manufacturers was small. In addition, exports were relatively concentrated, and the spot volume of manufacturers has remained relatively tense. Domestic prices rose to around 10,800 yuan/ton, and the high-end rose to 11,500-11,800 yuan/ton; by April, the construction volume of the domestic downstream hot-melt coating market was lower than expected, and the operating rate remained around 70%. The demand side was weak, and the market shortage situation was alleviated. By the end of the month, there was local pressure on shipments , and manufacturers made small concessions, and the overall price was still running high. In May, the price entered a slow downward channel. First, some units were temporarily overhauled. Second, the downward rate of raw material C5 accelerated in the second half of the month. Third, the sharp increase in shipping costs caused a decrease in subsequent orders after the order was delivered. Fourth, the more concentrated precipitation in the south caused a decrease in construction volume. After experiencing the concentrated impact of the market in May, the price fell by 400 yuan/ton in total. In June, the price of C5 petroleum resin entered an accelerated downward channel, with a price drop of 500 yuan/ton to 9,500 yuan/ton, and a concentrated decline of 800 yuan/ton in some areas. By the end of June, the mainstream transaction price in the market fell to 9,500 yuan/ton, and the local price remained around 9,300 yuan/ton. The price of C5 petroleum resin for road sign paint increased by 16.23% year-on-year and 5.89% month-on-month.

Data source: Longzhong Information

2. The plant operating rate increased by 6.48% year-on-year, mainly due to the increase in volume and price

Table 16 Comparison of C5 Petroleum Resin Production/Operation Changes in the First Half of 2024

Unit: 10,000 tons, %, percentage point

| project | First half of 2024 | Second half of 2023 | First half of 2023 | Month-on-month % | Year-on-year % |

| Total production | 23.5 | 22.43 | 21.42 | 4.75% | 9.69% |

| Capacity utilization | 73.32% | 70% | 66.84% | 3.33% | 6.48% |

Data source: Longzhong Information

In the first half of 2024, my country's C5 petroleum resin production was 235,000 tons, up 9.69% year-on-year, showing a significant increase. The average capacity utilization rate in the first half of the year was 73.32%, up 6.48% year-on-year. The main reason is that the production capacity of C5 petroleum resin has basically not fluctuated, and the temporary shutdown of C5 petroleum resin in foreign plants in the first half of the year and the influence of domestic cracking C5 residual liquid policies have aggravated the downstream periodic replenishment demand, and the output and plant operating rate have increased simultaneously. In terms of plant maintenance, some plants underwent temporary maintenance due to the Spring Festival holiday in the first quarter. In the second quarter, due to the maintenance of upstream ethylene cracking plants and the influence of the policy of cracking C5 residual liquid, the maintenance was relatively concentrated, and the maintenance loss was 42,700 tons. Overall, the price of C5 petroleum resin remained high in the first half of the year, and the operating rate increased by 3.33% month-on-month and 6.48% year-on-year.

3. Downstream demand is relatively stable

Data source: Longzhong Information

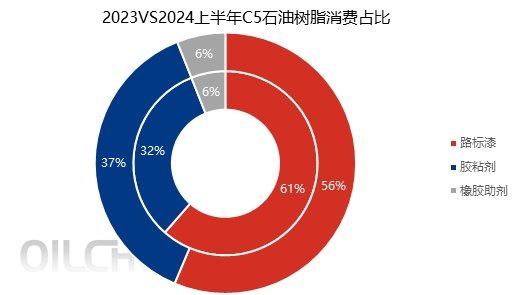

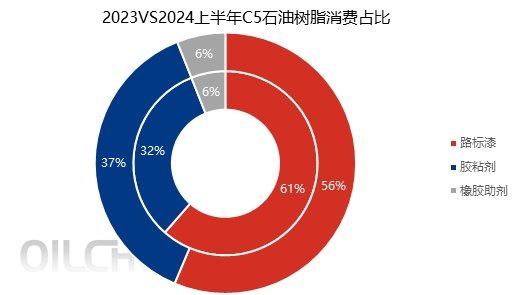

In the first half of 2024, among the domestic C5 petroleum resin downstream consumption, adhesive consumption increased by 5% to 37%, while road sign paint decreased by 5% to 56%, and rubber additives and others remained basically stable at 6%. From the perspective of downstream construction, road sign paint has slowed down investment in some infrastructure projects, and some of them are mainly small orders, so the market transaction volume is slightly insufficient. Hot melt adhesive consumption is driven up as domestic express delivery business maintains rapid growth; demand for rubber additives and others is relatively stable.

4. Market forecast of C5 petroleum resin

In the second half of 2024, there will be no new production capacity for road sign paint C5 petroleum resin manufacturers , and the policy of cracking C5 residual liquid will be gradually implemented, and the international oil price will remain high, which will support the price of industrial cracking C5, and the cost pressure of manufacturers will be relatively large; the negative factors are that the inflow of deep processing of cracking C5 in the second half of the year will increase by 100,000 tons due to the commissioning of new production capacity, the operation time of industrial cracking C5 will be extended, and the price rebound may be less than expected; on the other hand, the rainfall in the south of China is more concentrated and the north has also entered the rainy season. The domestic precipitation is higher than in previous years, which may cause some construction to be slightly delayed, and the slow collection of paint manufacturers also drags down the enthusiasm for stocking. It is expected that in the second half of the year, the temporary maintenance of road sign paint C5 petroleum resin manufacturers will be more concentrated in July and August, and the high international oil price will support the bottoming out of industrial cracking C5 prices. The price may bottom out in late July and early August. With the arrival of the peak season in August and September, the price of C5 petroleum resin will rise and it will be difficult to support the price to recover to the high level in the first half of the year. The downward construction volume in November will drag the price down.

Data source: Longzhong Information

In the second half of 2024, there will be no new production capacity released by manufacturers of adhesive C5 petroleum resin. In view of the high operation of isoprene in the first half of the year, isoprene will decline in the second half of the year due to the new production capacity of Jiangsu Hongjing and Panjin Ikos, as well as the continued weakening of curing agent and C5 petroleum resin prices. From the demand side, foreign shipping costs continue to run high, and the European market may be partially replaced by American rosin resin, and the export volume may decline slightly. Domestic downstream demand continues to rise slightly due to concentrated shopping festivals. In terms of policy, the policy of cracking C5 residual liquid is gradually implemented, and the cost pressure of manufacturers will generally increase. Overall, the price of adhesive C5 petroleum resin continued to fall in July and August. With the active stocking before the peak consumption season and foreign holidays, shipping costs may fall, exports will recover, and the market will continue to rebound in September. The rebound in prices is indeed difficult to return to the highs in the first half of the year. As the output in the second half of the year is still 5% higher than that in the first half of the year, some manufacturers may face shipping pressure at the end of the year, and prices will fall slightly.